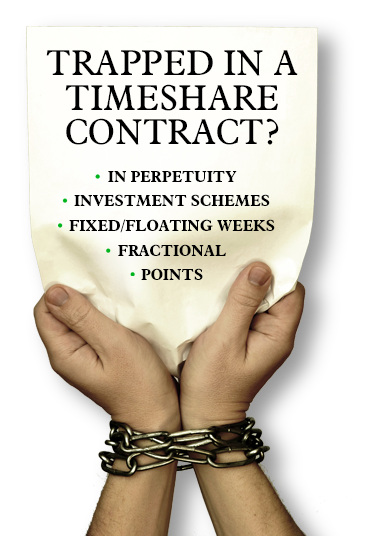

7 Timeshare Compensation Secrets Your Timeshare Company Doesn’t Want You To Know

Not all timeshare companies are completely unscrupulous. Some may be sharks, but others truly believe in their product. Nonetheless, there are risks and downsides to timeshare that even the most upstanding timeshare companies don’t want you to know about. Let’s take a look at some of the things your timeshare company might be trying to keep secret!

-

You didn’t sign the full contract

As sneaky as it may seem, timeshare companies rarely give their customers a full contract to sign. Instead, they provide an abridged version. Within this version, they use conniving language in order to include clauses that are included the full contract. Because they won’t inform you that it’s an abridged contract, you are likely to end up agreeing to things you have never been told about.

Always ask to see a full, unedited contract before signing anything.

-

The risk level is off the charts

Aside from the never-ending annual fees, there is an additional risk to purchasing a timeshare.

By buying a timeshare, you are essentially buying a portion of real estate. This means that you are partly responsible for the building were something to happen to it. Any form of natural disaster, for example, which causes damage to the property, will result in you having to contribute towards the repairs.

-

You have the legal right to have a lawyer check your contract before signing

Timeshare companies will attempt to have you sign their contract as soon as they possibly can.

They will suggest that time is of the essence and that, if you don’t sign right now, you will miss out on a great opportunity. But they’re lying.

The last thing they want you to do is to show the contract to an independent lawyer, in fear that doing so will bring to light aspects of the contract that should be avoided at all costs. It is your legal right to have it checked, so always do.

-

Some elements of your contract might be against the law

Many of the underhand tricks that timeshare companies use when selling their product have now been ruled unlawful. Incredibly, this hasn’t stopped them from trying their luck and to this day, illegal contracts are sold.

Laws surrounding cooling-off periods, Flex-time and perpetuity clauses all offer the potential to have a breaching contract voided. Nobody is going to tell you, so it’s important to do your research.

-

You will lose half of your investment when you sell

Even the very best timeshare company won’t want you to know this one! Timeshares are notoriously difficult to sell on. Because they are an unstable investment in the first place, selling an existing one is tricky; nobody really wants them.

If you are lucky enough to find someone who wants your timeshare, you will make back less than half of what you put in. As soon as you buy a timeshare it’s value drops by around 50%.

-

You’d be better off renting

As much as your timeshare company might believe in their product, there’s no avoiding the fact that it’s just cheaper to rent an apartment or hotel room as normal. Even renting someone else’s unused timeshare unit is a better option! It is not unusual for people with timeshares to be unable to use them every year. When they can’t, they will put their week up for rent. It’s an attempt to make back at least some of the yearly fees they must pay regardless.

Renting an unused week in a timeshare is a much safer and cost effective way of taking a holiday.

-

You still have to get there

You have to bear in mind that on top of your upfront costs and annual fees, you also have to pay for every other aspect of your holiday as usual. This means travel, spending money and insurance.

When everything is counted, timeshares rarely provide a cheaper option to a regular holiday package. And even if you just miss one year, you are instantly out of pocket.

Timeshare Compensation

Timeshare Compensation